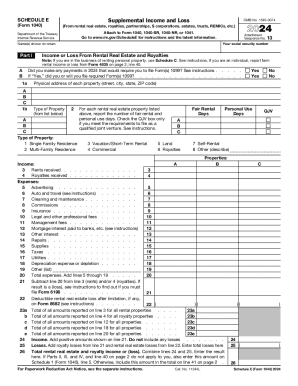

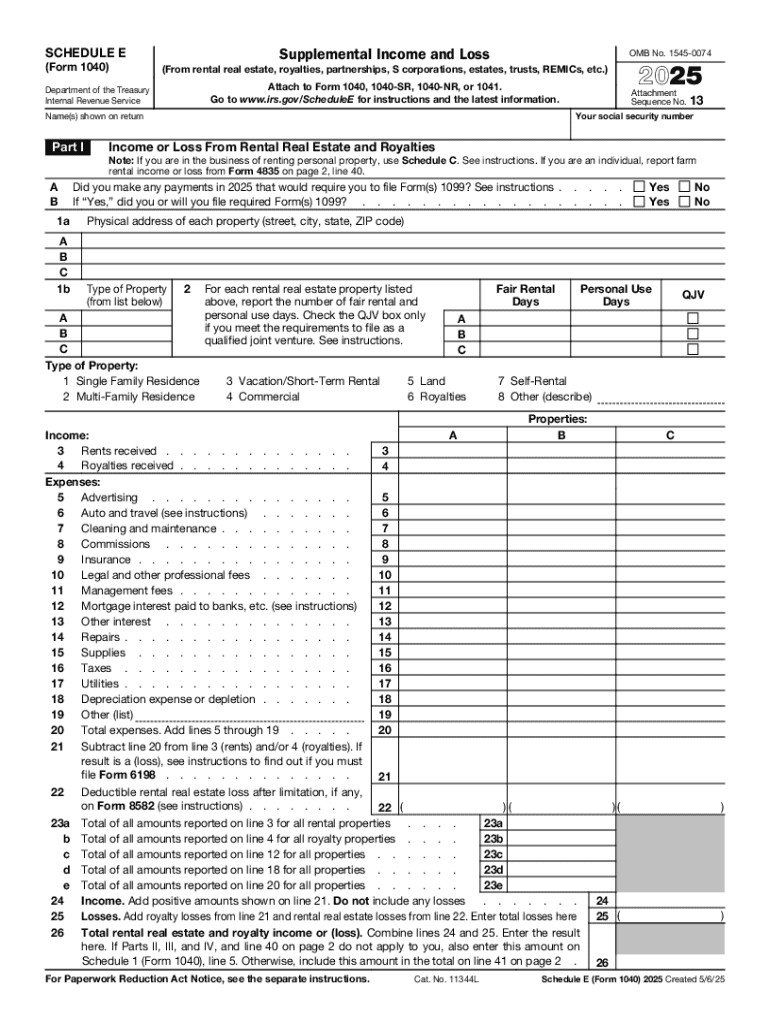

IRS 1040 - Schedule E 2025-2026 free printable template

Instructions and Help about IRS 1040 - Schedule E

How to edit IRS 1040 - Schedule E

How to fill out IRS 1040 - Schedule E

Latest updates to IRS 1040 - Schedule E

All You Need to Know About IRS 1040 - Schedule E

What is IRS 1040 - Schedule E?

Who needs the form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040 - Schedule E

What should I do if I realize I've made a mistake on my IRS 1040 - Schedule E?

If you need to correct an error on your IRS 1040 - Schedule E, you should file an amended return using Form 1040-X. This process allows you to adjust any incorrect income, deductions, or credits. Make sure to include a corrected Schedule E along with the 1040-X to detail the changes.

How can I track the status of my IRS 1040 - Schedule E after filing?

You can verify the status of your IRS 1040 - Schedule E by using the IRS 'Where's My Refund?' tool if you are expecting a refund. For e-filings, common rejection codes can guide you in resolving issues that may prevent processing. It’s crucial to monitor your status if you encounter any delays.

Are there specific legal considerations when filing an IRS 1040 - Schedule E for foreign payees?

When dealing with nonresidents or foreign payees on your IRS 1040 - Schedule E, it's essential to understand the proper tax obligations and withholding requirements. Additionally, having an authorized representative with power of attorney can simplify interactions with the IRS on behalf of nonresidents.

What common errors should I avoid on my IRS 1040 - Schedule E?

One common mistake when completing an IRS 1040 - Schedule E is incorrectly reporting income or expenses. Make sure to double-check your calculations and ensure all relevant income sources are included. Additionally, failing to include necessary supplemental information can lead to delays or issues with processing.

See what our users say